hawaii state tax id number

A sellers permit also called a sales tax ID or a state employer Number ID for employee tax withholding. To get a federal Tax Id Number state Tax Id Number or sellers number click here.

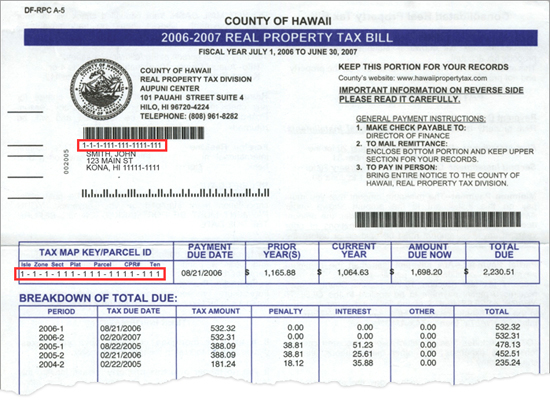

County Of Hawai I Online Real Property Tax Payments

You need that to buy wholesale sell retail or sell wholesale as well as to lease tangible goods.

. Benefits of using Hawaii Tax Online. Please remember that if your question is not answered here send us an email at TaxpayerServiceshawaiigov. When tax accounts move to the new system existing Hawaii Tax ID numbers will be replaced with a new number and format.

Get a Tax ID Sellers Permit DBA LLC or Incorporation Here Online. This detail begins with the letter L and you can find it listed. A wholesale License is a sales tax ID number.

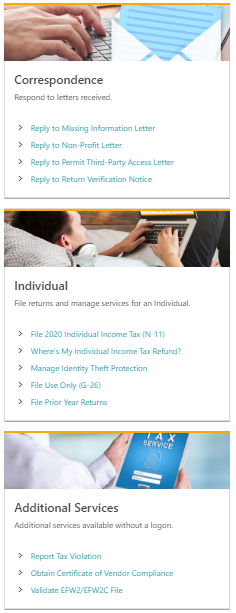

A HI Sales Tax ID Number 39 Also Called a Sellers Permit Wholesale ID Resale Reseller ID. The Hawaii Tax ID starts with a two-letter account type identifier followed by 12 digits. Tax Services Hawaiʻi Tax Online Hawaiʻi Tax Online is the convenient and secure way to get a State Tax Identification Number BB-1 file tax returns make payments manage your accounts and conduct other common transactions online with the Hawaiʻi Department of Taxation.

They issue a Tax ID number for sellers to collect these tax and pay the state. Starting A Buiness 782022 1209 PM - Leavenworth. To request a form by mail or fax you may call our Taxpayer Services Form Request Line at 808-587-4242 or toll-free 1-800-222-3229.

The new Hawaii Tax ID number format makes it easy to distinguish between customer ID and Hawaii Tax ID account numbers. See a full list of all available functions on the site. THERE ARE 4 TAX ID NUMBERS A Hawaii Business Tax Registration ID A HawaiiState Sales Tax ID Number A Federal Tax Id Number EIN A Hawaii Employer ID Number Obtain Your Tax IDs Here Online.

Hawaii Tax Online FAQ PDF 3 pages 136 KB 892021. Ige approved this measure on June 22 2022 and it. The Hawaii Letter ID.

For others it is desirable to obtain an EIN number Hawaii because it limits the number of people who have access to your Social Security number. Its the unique identification number assigned to each Hawaii tax account. Heres a Few Other Tax Documents and.

Please review the System Requirements first. Get These Now Online. A HI State EIN 39 This is the state version of an employer ID number.

It is NOT the same as your Hawaii Tax ID. Hawaii Tax ID number prefixes also make it possible to know the associated tax type at a glance. This ID number should not be associated with other types of tax accounts with the state of Hawaii such as income tax.

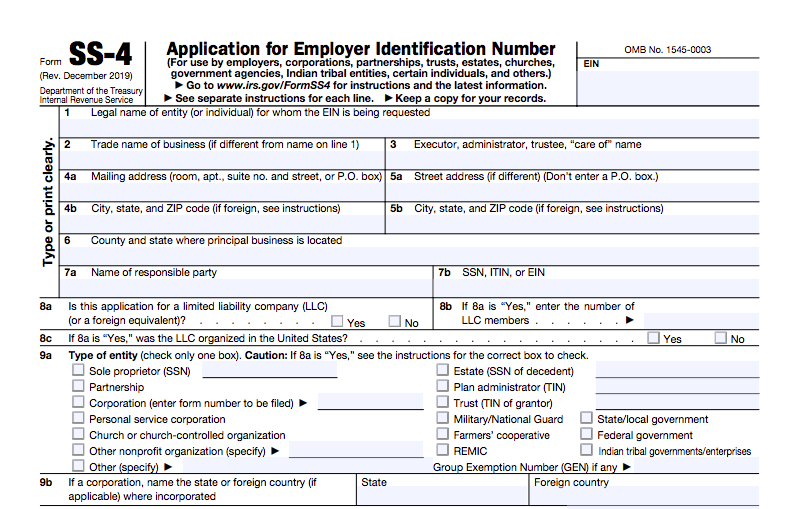

It is a nine-digit number than can be used in lieu of your Social Security number. Get These Now Online. The Hawaii State Tax ID.

Find out more here or ask your lawyer bookkeeper or accountant to do this for you. EIN stands for employee identification number. For example if you have incorporated your LLC you may need a new Hawaii tax ID number.

The GE account type stands for General ExciseUse and County Surcharge Tax. This is a unique identification credential that Hawaiis Department of Taxation issues to license holders. A Hawaii tax id number can be one of two state tax ID numbers.

The Department has put together a list of commonly asked questions and answers. Then there is a Federal Tax ID Number a Business Tax Registration Number and a Social Security Number for your personal income tax. For many businesses it is a requirement.

State Tax Id Numbers For Hawaii Placer County Lincoln Web Based Business Lincoln 95648. Get Started Firstall businesses need a. Or if you have received a new charter from the Secretary of.

This links to the Adobe web site where step-by-step instructions are available. A HI Sales Tax ID Number 39 Also Called a Sellers Permit Wholesale ID Resale Reseller ID. Send us a secure web message Hawaii Tax Online FAQ PDF 3 pages 136 KB 892021.

514 which provides a refund for resident taxpayers who file their 2021 individual tax return Form N-11 on or before December 31 2022. This is your license or registration number for your General ExciseUse and County Surcharge Tax GE account. Individuals can register online to receive their ID by filing Form BB-1 through Hawaii Business Express.

Changes youve made to your business as it has grown and expanded may require you to apply for a new EIN. To ensure your privacy a Clear Form button has been placed on all current writable forms. Once the federal government issues you a tax identification number you will have to get a state Tax Id Number from Hawaii as well.

File returns and make payments Check account balances and financial summary information. A HI State EIN 39 This is the state version of an employer ID number. 247 access to clients tax accounts.

You need that to buy wholesale sell retail or sell wholesale as well as to lease tangible goods. The 2022 Hawaii State Legislature passed SB. A Hawaii Federal Tax ID Number which is also known as an Employer ID Number EIN or Federal Tax Identification Number is a unique nine-digit ID assigned by the Internal Revenue Service for tax purposes for businesses as well as Non-Profit organizations Trusts and Estates.

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

Hawaii What Is My Letter Id Taxjar Support

Tax Clearance Certificates Department Of Taxation

Ein Comprehensive Guide Freshbooks

Free Salvation Army Donation Receipt Word Pdf Eforms

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

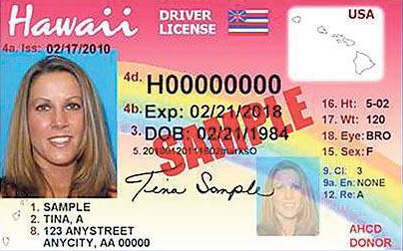

State To Change Id Card Driver S License Process Honolulu Star Advertiser

Licensing Information Department Of Taxation

State Of Hawaii Department Of Taxation Faqs

Tax Id Numbers Why They Re Important And How To Get One Bench Accounting

Understanding The Employer Identification Number Ein Lookup

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation